Page 123 - Hospital Authority Annual Report 2015-1016

P. 123

Notes to the Financial Statements 財務報表附註

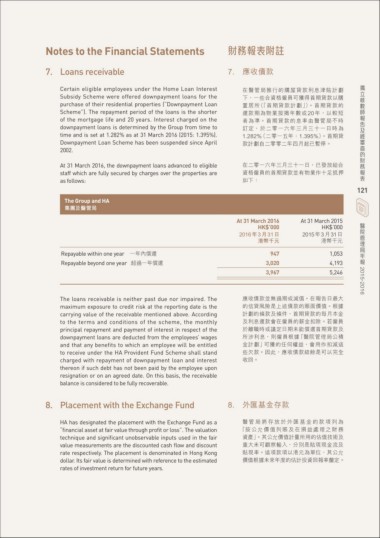

7. Loans receivable 7. 應收債款

Certain eligible employees under the Home Loan Interest 在醫管局推行的購屋貸款利息津貼計劃 獨

Subsidy Scheme were offered downpayment loans for the 下,一些合資格僱員可獲得首期貸款以購 立

purchase of their residential properties (“Downpayment Loan 置 居 所(「首 期 貸 款 計 劃 」)。 首 期 貸 款 的 核

Scheme”). The repayment period of the loans is the shorter 還款期為物業按揭年數或 20 年,以較短 數

of the mortgage life and 20 years. Interest charged on the 者 為 準。 首 期 貸 款 的 息 率 由 醫 管 局 不 時 師

downpayment loans is determined by the Group from time to 訂 定, 於 二 零 一 六 年 三 月 三 十 一 日 時 為 報

time and is set at 1.282% as at 31 March 2016 (2015: 1.395%). 1.282%(二零一五年:1.395%)。首期貸 告

Downpayment Loan Scheme has been suspended since April 款計劃自二零零二年四月起已暫停。 及

2002. 經

在二零一六年三月三十一日,已發放給合 審

At 31 March 2016, the downpayment loans advanced to eligible 資格僱員的首期貸款並有物業作十足抵押 查

staff which are fully secured by charges over the properties are 如下: 的

as follows: 財

務

The Group and HA At 31 March 2016 At 31 March 2015 報

集團及醫管局 HK$’000 HK$’000 表

Repayable within one year 一年內償還 2016 年 3 月 31 日 2015 年 3 月 31 日 121

Repayable beyond one year 超過一年償還 港幣千元 港幣千元

醫

947 1,053 院

4,193 管

3,020 5,246 理

局

3,967 年

報

2015-2016

The loans receivable is neither past due nor impaired. The 應收債款並無過期或減值。在報告日最大

maximum exposure to credit risk at the reporting date is the 的信貸風險是上述債款的賬面價值。根據

carrying value of the receivable mentioned above. According 計劃的條款及條件,首期貸款的每月本金

to the terms and conditions of the scheme, the monthly 及利息還款會在僱員的薪金扣除。若僱員

principal repayment and payment of interest in respect of the 於離職時或議定日期未能償還首期貸款及

downpayment loans are deducted from the employees’ wages 所涉利息,則僱員根據「醫院管理局公積

and that any benefits to which an employee will be entitled 金計劃」可獲的任何權益,會用作扣減這

to receive under the HA Provident Fund Scheme shall stand 些欠款。因此,應收債款結餘是可以完全

charged with repayment of downpayment loan and interest 收回。

thereon if such debt has not been paid by the employee upon

resignation or on an agreed date. On this basis, the receivable

balance is considered to be fully recoverable.

8. Placement with the Exchange Fund 8. 外匯基金存款

HA has designated the placement with the Exchange Fund as a 醫 管 局 將 存 放 於 外 匯 基 金 的 款 項 列 為

“financial asset at fair value through profit or loss”. The valuation 「按 公 允 價 值 列 賬 及 在 損 益 處 理 之 財 務

technique and significant unobservable inputs used in the fair 資產」。其公允價值計量所用的估值技術及

value measurements are the discounted cash flow and discount 重大未可觀察輸入,分別是貼現現金流及

rate respectively. The placement is denominated in Hong Kong 貼現率。這項款項以港元為單位,其公允

dollar. Its fair value is determined with reference to the estimated 價值根據未來年度的估計投資回報率釐定。

rates of investment return for future years.