Page 97 - Hospital Authority Annual Report 2019-2020

P. 97

NOTES TO THE FINANCIAL 財務報表附註

STATEMENTS

12. Accounts receivable (Continued) 12. 應收賬款 (續)

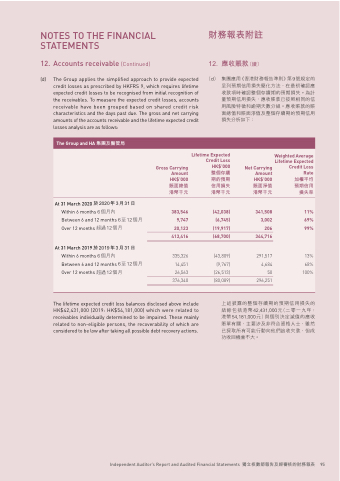

(d) The Group applies the simplified approach to provide expected (d) 集團應用《香港財務報告準則》第9號規定的

credit losses as prescribed by HKFRS 9, which requires lifetime 呈列預期信用損失簡化方法,在最初確認應

expected credit losses to be recognised from initial recognition of 收款項時確認整個存續期的預期損失。為計

the receivables. To measure the expected credit losses, accounts 量預期信用損失,應收賬款已按照相同的信

receivable have been grouped based on shared credit risk 用風險特徵和逾期天數分組。應收賬款的賬

characteristics and the days past due. The gross and net carrying 面總值和賬面淨值及整個存續期的預期信用

amounts of the accounts receivable and the lifetime expected credit 損失分析如下:

losses analysis are as follows:

The Group and HA 集團及醫管局

Lifetime Expected Weighted Average

Credit Loss Lifetime Expected

Gross Carrying HK$’000 Net Carrying Credit Loss

Amount 整個存續 Amount Rate

HK$’000 期的預期 HK$’000 加權平均

賬面總值 信用損失 賬面淨值 預期信用

港幣千元 港幣千元 港幣千元 損失率

At 31 March 2020 於2020年3月31日

Within 6 months 6個月內 383,546 (42,038) 341,508 11%

Between 6 and 12 months 6至12個月 9,747 (6,745) 3,002 69%

Over 12 months 超過12個月 20,123 (19,917) 206 99%

413,416 (68,700) 344,716

At 31 March 2019 於2019年3月31日

Within 6 months 6個月內 335,326 (43,809) 291,517 13%

Between 6 and 12 months 6至12個月 14,451 (9,767) 4,684 68%

Over 12 months 超過12個月 26,563 (26,513) 50 100%

376,340 (80,089) 296,251

The lifetime expected credit loss balances disclosed above include 上述披露的整個存續期的預期信用損失的

HK$42,431,000 (2019: HK$54,181,000) which were related to 結餘包括港幣42,431,000元(二零一九年:

receivables individually determined to be impaired. These mainly 港幣54,181,000元)與個別決定減值的應收

related to non-eligible persons, the recoverability of which are 賬單有關,主要涉及非符合資格人士,雖然

considered to be low after taking all possible debt recovery actions. 已採取所有可能行動向他們追收欠款,但成

功收回機會不大。

Independent Auditor’s Report and Audited Financial Statements 獨立核數師報告及經審核的財務報表 95