ৌਕజ

ڝڌ

ൗ

ᚃ

Independent Auditor’s Report and Audited Financial Statements

獨立核數師報告及經審查的財務報表

Notes to the Financial Statements

(Continued)

(i)

按公允價值列賬的財務資產(續)

如一項或多項重大輸入並非根據可觀察市場數

據,這些工具屬於第三層。

用以估值金融工具的特定估值技術包括:

—

同類型工具的市場報價或交易商報價;

—

遠期外匯合約的公允價值使用報告日的遠

期匯率釐定,而所得價值折算至現值;

—

其他技術,例如折算現金流分析,用以釐

定其餘金融工具的公允價值。

外匯基金存款屬於第三層。下表呈列截至二零

一四年三月三十一日止及二零一三年三月

三十一日止年度第三層工具的變動:

(ii)

非以公允價值呈列的財務資產

固定入息工具(包括港元債券及外匯基金債券)

在報告日的公允價值由向其購買工具的銀行提

供,現概列如下:

3.

ৌਕࠬᎈ၍ଣ

(續)

(b)

公允價值估計

(續)

3. Financial riskmanagement

(Continued)

(b) Fair values estimation

(Continued)

(i)

Financial assets carried at fair values (Continued)

If one or more of the significant inputs is not based on observable

market data, the instrument is included in level 3.

Specific valuation techniques used to value financial instruments

include:

— Quoted market prices or dealer quotes for similar instruments.

— The fair value of forward foreign exchange contracts is

determined using forward exchange rates at the reporting

date, with the resulting value discounted back to present

value.

— Other techniques, such as discounted cash flow analysis, are

used to determine fair value for the remaining financial

instruments.

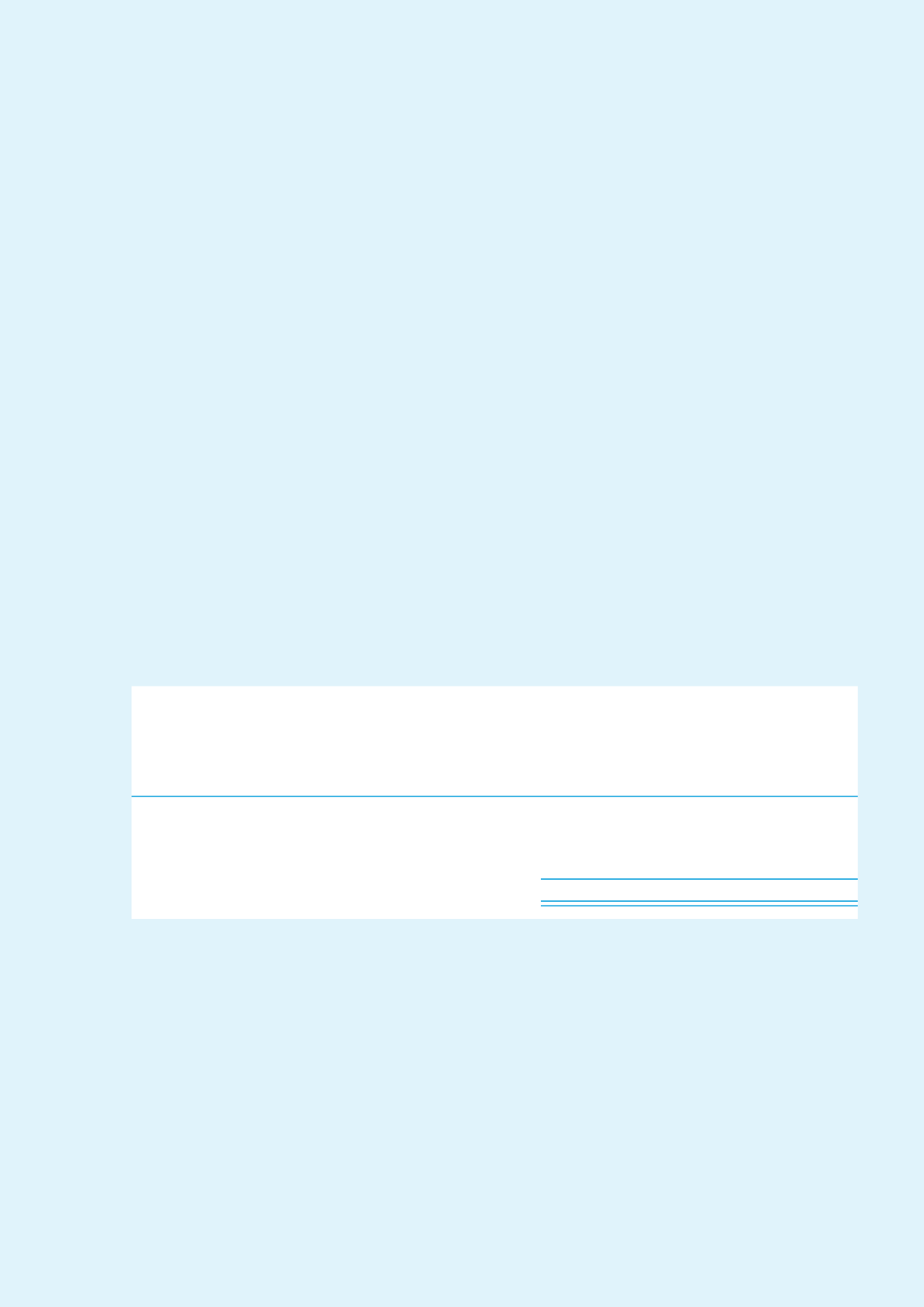

The placement with the Exchange Fund is included in level 3. The

following table presents the changes in level 3 instruments for the

financial years ended 31 March 2014 and 31 March 2013:

For the year ended

31 March 2014

HK$’000

࿚Ї

2014

ϋ

3

˜

31

˚˟ϋ

ܓ

ಥ࿆ɷʩ

For the year ended

31 March 2013

HK$’000

截至

2013

年

3

月

31

日止年度

港幣千元

At beginning of year

於年初

6,124,158

–

Addition

增加

–

6,000,000

Interest from placement with the Exchange Fund

外匯基金存款利息收入

284,280

124,158

At end of year

於年終

6,408,438

6,124,158

(ii) Financial assets not reported at fair values

The fair values of fixed income instruments (including Hong Kong

dollar bonds and Exchange Fund notes) at the reporting date were

provided by the banks from whom the instruments were

purchased. These instruments were summarised below:

114

Hospital Authority Annual Report 2013-2014