Page 125 - P3951_HA_AR14-15_Final Full Set_Chi_20160111_4pm

P. 125

Independent Auditor’s Report and Audited Financial Statements

獨立核數師報告及經審查的財務報表

Notes to the Financial Statements 財務報表附註

8. Placement with the Exchange Fund (Continued) 8. (續)

The interest on the placement is at a fixed rate determined annually in 這筆存款的息率固定,在每年一月釐定,並於每年

January and payable annually in arrears on 31 December. The rate of 十二月三十一日支付。回報率是按外匯基金投資組合

return is calculated on the basis of the average annual rate of return on 過往六年的平均投資回報率,或三年期外匯基金債券

certain investment portfolio of the Exchange Fund over the past six years 過去一年的平均年度收益率計算(最低為 0%),以較

or the average annual yield of three-year Exchange Fund Notes in the 高者為準。二零一四年一月至十二月及二零一五年一

previous year (subject to a minimum of zero percent), whichever is the 月至十二月的每年回報率分別為 3 .6% 及 5 .5%。醫管局

higher. This rate of return has been fixed at 3.6% and 5.5% per annum for 沒有支取截至二零一四年十二月三十一日賺取的利

January to December 2014 and January to December 2015, respectively. 息,這些款項會按本金可享息率繼續積存利息。

HA did not withdraw the interest earned up to 31 December 2014 which

would continue to accrue interest at the same rate payable for the

principal amount.

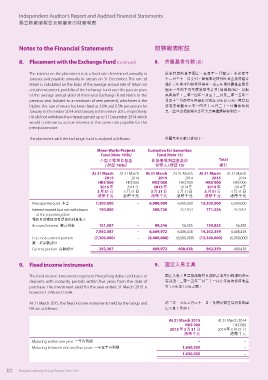

The placement with the Exchange Fund is analysed as follows:: 外匯基金存款分析如下:

Minor Works Projects Custodian for Samaritan Total

Fund [Note 19(b)] Fund [Note 15]

[ 19(b)] [ 15]

Principal Amount 本金 At 31 March At 31 March At 31 March At 31 March At 31 March At 31 March

Interest earned but not withdrawn 2015 2014 2015 2014 2015 2014

at the reporting date HK$’000 HK$’000 HK$’000 HK$’000 HK$’000 HK$’000

報告日所獲但沒有提取的利息收入 2015 2014 年 2015 2014 年 2015 2014 年

Accrued interest 應計利息 3 31 3 月 31 日 3 31 3 月 31 日 3 31 3 月 31 日

港幣千元 港幣千元 港幣千元

Less: non-current portion 7,300,000 6,000,000 13,300,000

減:非流動部分 190,800 – 580,726 6,000,000 771,526 6,000,000

Current portion 流動部分 – 352,053 352,053

101,587

7,592,387 – 89,246 56,385 190,833 56,385

(7,300,000) – 6,669,972 6,408,438 14,262,359 6,408,438

– (6,000,000) (6,000,000) (13,300,000) (6,000,000)

292,387

– 669,972 408,438 962,359 408,438

9. Fixed income instruments 9.

The fixed income instruments represent Hong Kong dollar certificates of 固定入息工具是指由購買日期起計五年內到期的港元

deposits with maturity periods within five years from the date of

purchase. The investment yield for the year ended 31 March 2015 is 存款證,二零一五年三月三十一日止年度的投資收益

between 1.75% and 2.55%. 在 1 .75% 至 2 .55% 之間。

At 31 March 2015, the fixed income instruments held by the Group and 於二零一五年三月三十一日,集團及醫管局持有的固

HA are as follows: 定入息工具如下:

Maturing within one year 一年內到期 At 31 March 2015 At 31 March 2014

Maturing between one and five years 一至五年內到期 HK$’000 HK$’000

2015 3 31 2014 年 3 月 31 日

港幣千元

–

1,650,000 –

1,650,000 –

–

122 Hospital Authority Annual Report 2014-2015