Page 109 - P3951_HA_AR14-15_Final Full Set_Chi_20160111_4pm

P. 109

Independent Auditor’s Report and Audited Financial Statements

獨立核數師報告及經審查的財務報表

Notes to the Financial Statements 財務報表附註

2. Principal accounting policies (Continued) 2. (續)

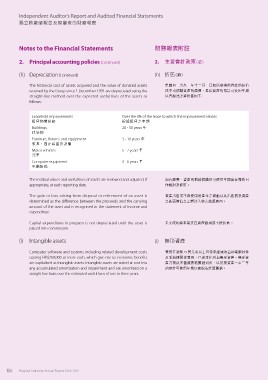

(h) Depreciation (Continued) (h) 折舊(續)

The historical cost of assets acquired and the value of donated assets 集團自一九九一年十二月一日起所取得的資產的原值

received by the Group since 1 December 1991 are depreciated using the 成本或捐贈資產的價值,是按資產的預計可使用年期

straight-line method over the expected useful lives of the assets as 以直線法計算折舊如下:

follows:

Leasehold improvements Over the life of the lease to which the improvement relates

租賃物業裝修 根據租賃之年期

Buildings 20 - 50 years 年

建築物

3 - 10 years 年

Furniture, fixtures and equipment

家具、固定裝置及設備 5 - 7 years 年

Motor vehicles 3 - 6 years 年

汽車

Computer equipment

電腦設備

The residual values and useful lives of assets are reviewed and adjusted, if 如有需要,資產的剩餘價值及可使用年期會在報告日

appropriate, at each reporting date. 作檢討及修訂。

The gain or loss arising from disposal or retirement of an asset is 資產出售或不再使用所產生之盈虧以其出售價及資產

determined as the difference between the proceeds and the carrying 之賬面價值之差額計入收支結算表內。

amount of the asset and is recognised in the statement of income and

expenditure.

Capital expenditure in progress is not depreciated until the asset is 未完成的資本開支在資產啟用前不提折舊。

placed into commission.

(i) Intangible assets (i) 無形資產

Computer software and systems including related development costs 費用在港幣 25 萬元或以上可帶來經濟效益的電腦軟件

costing HK$250,000 or more each, which give rise to economic benefits 及系統連開發費用,已資本化列為無形資產。無形資

are capitalised as intangible assets. Intangible assets are stated at cost less 產乃按成本值減累積攤銷列出,以及按資產一至三年

any accumulated amortisation and impairment and are amortised on a 的預計可使用年期以直線法計算攤銷。

straight line basis over the estimated useful lives of one to three years.

106 Hospital Authority Annual Report 2014-2015