Page 128 - P3951_HA_AR14-15_Final Full Set_20160111_4pm

P. 128

Independent Auditor’s Report and Audited Financial Statements

獨立核數師報告及經審查的財務報表

Notes to the Financial Statements 財務報表附註

11. Accounts receivable (Continued) 11. (續)

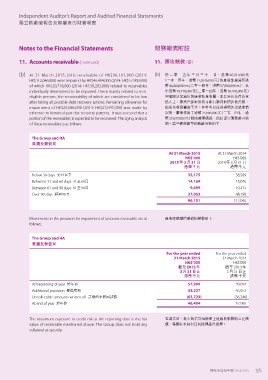

(b) At 31 M arch 2015, bills receivable of HK$96,101,000 (2014: (b) 於 二 零 一 五 年 三 月 三 十 一 日, 港 幣 96,101,000 元

HK$112,046,000) were impaired by HK$46,404,000 (2014: HK$57,900,000) (二零一四年:港幣 112,046,000 元)的應收賬單減值港

of which HK$20,718,000 (2014: HK$30,203,000) related to receivables 幣 46,404,000 元 ( 二零一四年:港幣 57,900,000 元),其

individually determined to be impaired. These mainly related to non- 中港幣 20,718,000 元(二零一四年:港幣 30,203,000 元)

eligible persons, the recoverability of which are considered to be low

after taking all possible debt recovery actions. Remaining allowance for 與個別決定減值的應收賬單有關,主要涉及非符合資

impairment of HK$25,686,000 (2014: HK$27,697,000) was made by

reference to historical past due recovery patterns. It was assessed that a 格人士,雖然已採取所有可能行動向他們追收欠款,

portion of the receivables is expected to be recovered. The aging analysis

of these receivables is as follows: 但成功收回機會不大。在參考以往的過期欠款追收情

況後,繼而作出了港幣 25,686,000 元(二零一四年:港

幣 27,697,000 元)餘額減值備抵,估計部分賬款應可收

回。這些應收賬單的賬齡分析如下:

The Group and HA

Below 30 days 30 日以下 At 31 March 2015 At 31 March 2014

Between 31 and 60 days 31 至 60 日 HK$’000 HK$’000

Between 61 and 90 days 61 至 90 日

Over 90 days 超過 90 日 2015 3 31 2014 年 3 月 31 日

港幣千元

35,175

14,164 38,589

15,046

9,699 10,215

37,063 48,196

96,101 112,046

Movements in the provision for impairment of accounts receivable are as 應收賬款減值撥備的變動如下:

follows:

For the year ended For the year ended

The Group and HA 31 March 2015 31 March 2014

HK$’000 HK$’000

At beginning of year 於年初 2015 截至 2014 年

Additional provision 撥備增加 3 31 3 月 31 日止

Uncollectible amounts written off 註銷的未收回款額 港幣千元

At end of year 於年終 57,900

52,227 49,094

The maximum exposure to credit risk at the reporting date is the fair (63,723) 45,052

value of receivable mentioned above. The Group does not hold any 46,404 (36,246)

collateral as security. 57,900

在報告日,最大的信貸風險是上述應收賬款的公允價

值,集團並未持有任何抵押品作抵押。

2014-2015 125